When Can You Start Drawing Money From Lending Club

Note from the editor: As of 2022, Lending Club no more offers peer-to-peer lending.

Loaning Club was an online peer-to-peer (P2P) lending platform that took the banker out of banking. Investors would lend money directly to borrowers direct the website, enabling both to benefit from the rate of interest established for each loan.

Lending Club is no thirster offering this compeer-to-peer lending service, however. This review was originally ready-made at one time when Lending tree was one of the top names in the p2p blank space. There are still lessons to be lettered about P2P in imprecise, thus feel free to say in the lead but please think that Lending Club no longer offers this service.

And just as important, the uncastrated transaction happens online, eliminating the deman for sometimes embarrassing personal meetings unwashed with bank building loans. It's a win-win as both the investor and the borrower gain from the Lending Club process. Read more info here on getting a loan!

Lending Gild is legit for both investors and borrowers. This Loaning Club look back, unequal just about others, will review the service from both sides of the deal. Make foreordained to read about my experience beneath before you invest or borrow with Lending Club. Look into strange large ways to enthrone by meter reading our M1 Finance Investing Review as well.

Table of Table of contents

- Loaning Club At A Glance

- Is Lending Club Right For You?

- Loaning Club Review For Investors

- Lending Gild Review: For Borrowers

- How I'm Investing Using Lending Guild

- How Does Lending Club Compare?

- The Bottom Line

Lending Nightclub At A Glance

- Lending Club is no longer oblation P2P Lending (2021)

- $1,000 minimum investment

- Average returns between 5.06% and 8.74%

- Personal loans up to $40,000; Business loans in the lead to $300,000; Medical loans up to $50,000

- Best clad for good-credit borrowers and higher income investors

Is Lending Club Right For You?

Are you an investor looking to earn more than than the going rate?

Are you a borrower wanting to pay fewer than what the banks are charging?

Lending Club had been transforming the banking industry because of their peer-to-peer lending model that made those exact promises. And after I got my premiere try out of P2P investing, I realized I had to do a Lending Club review. IT was a avail suitable for those looking to invest as little as $1,000 operating theatre as much as $20,000. And they offered a multitude of loan products, from private to medical to business — many collateral-free.

That said, in that location are some downsides, or at to the lowest degree things to be aware of.

I'll cover the in and outs of peer-to-peer lending through Loaning Club from 3 different perspectives:

- The investor

- The borrower

- My personal feel for

Lending Club Follow-up For Investors

With interest rates on safety, fixed income investments unmoving broadly at below 1%, Lending Guild offers a genuine opportunity to get dramatically higher returns. As a matter of fact, you lavatory get median returns of between 5.06% and 8.74% (do I birth your attention now?).

Those are attractive rates, but just so we'ray clear, in that respect are more risks with Lending Club investments than there are with bank certificates of deposit. Plus, there are sure as shooting requirements you have to meet as an investor. Remember, the high the potential reward, the higher the risk of infection.

Investor Requirements

Notes are not procurable all told states. To invest in Notes direct the LendingClub program, you must reside in unmatched of the favourable states or the D.C.: Alabama, Arkansas, California, Colorado, Connecticut, Delaware, Georgia, Hawaii, Idaho, IL, Indiana, IA, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Mississippi, Montana, Nebraska, Nevada, Virgin Hampshire, Garden State, Oklahoma, Oregon, Rhode Island, South Dakota, Tennessee, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, and Wyoming.

If your express is not listed above, you may be eligible to trade Notes via the secondary commercialize. At this sentence, Ohio residents are non able to invest in Notes.

Depending on which state you live in, there are income requirements to invest in Loaning Nightclub. In most states, it's a minimum of $70,000 per class, though it may constitute higher in about states. Generally, the income requirement does not use if you have a minimum net worth of $250,000. The chopine also requires you to endow no more than 10% of your net worth in Lending Club notes.

The marginal opening invoice with Lending Club is $1,000 and $25 is the minimum requirement to empower in any single note. For retirement accounts, the minimum to open is $5,500.

Lending Club IRA

You can also hold Lending Club investments as part of an individual retirement describe (IRA). You force out do this through with a Loaning Club person-directed IRA. Lending Guild IRA requires an initial deposition of $5,500. That come allows you to start investment at a higher level and negates the need for monthly direction fees.

Loaning Club IRAs come in ii flavors, Traditional IRA or Roth IRA. Every bit you know, I'm a big fan of the Roth Ire. This is just same more elbow room you can invest in your future. But, I wouldn't keep all of your retirement money there. Roth IRAs aren't for everyone, and then equal sure to speak with a financial consultant before you sign up for this specific type of investment. Get word more about Roth IRA share limits here.

Choosing Notes to Invest In

There are cardinal ways to gift with Lending Club. Non-automatic investing is where you browse free loans and choose which ones you'll invest in one after another. But you can also use machine-controlled investing in which you set investment criteria, and notes are selected automatically based on that criteria.

While you buns invest in independent loans, it's generally best to buy them in fractions (which are referred to as notes). You can purchase notes in increments of $25. At the rattling least, you can purchase a fractional stake in 200 loans with a sum investment of $5,000. This will enable you to minimise the risk involved in investment in any single loan.

Aggregation Investment Returns

It's important to realise the notes you're investing in are not like certificates of sediment. Each note represents a lend that testament be repaid to you concluded the term of the loan. These payments will include both interest and principal.

That means at the end of the loanword condition, the lend will be completely extinguished (including 100% of your original principal endowed). For this reason, you bequeath need to reinvest payments acceptable happening a perpetual basis as you encounter payments.

Lending Club Lend Types and Loanword Grading

Lend terms are either 36 months or 60 months and are taped-rate. More than than 80% of the Lending Club loans are taken to refinance existing loans and quotation card balances. Standardised to other peer-to-peer loans, borrowers are evaluated – and loans are priced – supported on cite and credit scores, debt-to-income ratios (DTI), the length of your credit account, and your recent credit activity.

Each loanword is assigned a loan level, ranging from "A" (the highest) to "G" (the lowest). The higher the level, the lower the rate.

Within each letter grade, Lending Club likewise assigns a numerical rank of 'tween 1 and 5 (A1, A2, A3, A4, A5). These numeric sub-grades adjust for else factors, much as lend size and loan terminal figure. For lesson, a loan amount of $5,000 would be seen As low risk, and actually result in an improvement in the sub-grad. By contrast, the uttermost lend of $35,000 is a higher gamble, and could turn a B1 grade into a B4 or B5 grade, resulting in a slightly high interest rank.

Buying and Selling Notes Before they Overripe

Lending Golf-club offers their Line Trading Platform through Folio Investment where you can sell the remaining portion of a note under indisputable circumstances. This is a marketplace where investors can buy and sell Loaning Club notes to unrivalled some other.

Systematic to participate in this marketplace, you must also open a Folio Investing trading account through Lending Club. In that respect are no fees if you buy notes on the trading platform, but there is a 1% fee polar if you sell a note.

Risks with Lending and How to Minimize Them

Information technology's important to realize investments held done Lending Club are not bank assets, and as such they are not insured person by the FDIC. Individual loans put up go into default, and if they do, you will mislay that portion of your investment.

In summation, a missed payment by a borrower means you will not get the defrayment on that loan in this particular month. Lending Club does use "best practices" to collect payments from neglectful borrowers, but some volition nonpayment nonetheless.

When a defrayment is past due, you as an investor will pay a collection fee of 18% if the loan is at any rate 16 days past due but no judicial proceeding is involved. If judicial proceeding is required, you will be required to remuneration 30% of an attorney's hourly fees, plus attorney costs.

If solicitation efforts fail, and it is apparent the borrower cannot give back the loanword, the loan will atomic number 4 charged off once it is 150 days past due. When that happens, the unexhausted principal balance of the note bequeath be deducted from the investor's account balance. Whatever funds subsequently recovered on the defaulted loans will be returned to the investors on a pro-rata basis. This is a known run a risk if you gift in Lending Club, and you rarely see information technology fall up in whatever complaints that people have about the web site.

Just as is the case when you're investing in a portfolio of stocks and bonds, there are ways you tush invest in Lending Club that will reduce your overall adventure. The most obvious strategy, course, is to spreadhead your investment funds over many different loans – hundreds if you're in a position to do so.

You can minimize your adventure away setting sealed loanword requirements. For example, you may decide to set a credit score that is some number higher than what is required by Lending Order (currently 660). You tooshie also emphasize loans in which borrowers are refinancing existing debt, rather than pickings on new debt. Employment stableness is also a factor out. A person who has been employed in their field for a number of long time is in all probability to be more employable than one and only who is just starting out.

A low DTI is also a positive factor. For instance, you can make destined the borrowers whose loans you invest in own a DTI of less than, say, 30%. This way their fixed monthly expenses, including their housing expense, the new lend defrayal, and any other fixed payments arrange not exceed 30% of their total gross each month income.

Investor Fees

In that location are fees positively charged to investors with Loaning Gild. However, the fees are collected only when you receive a payment from a borrower. For example, there is a 1% service fee collected on apiece defrayal received.

Investing through Loaning Social club can provide you with excellent high-income diversification in a fixed income portfolio. Simply by investment a portion of your fixed-income allocation in Lending Club notes can increase the overall fruit on your fixed-income investments.

Lending Clubhouse Review: For Borrowers

Not solely rump you invest with Lending Club, merely you can also borrow with Lending Clubhouse as considerably! Truly, whatever your needs are, you can get a fancy softwood through Loaning Club.

You tail typically get lower interest rates connected loans through Lending Ball club than you can at a bank. You behind also apply for a lend without ever going your household. Everything is done online through the website, virtually eliminating the need for an uncomfortable face-to-face encounter at the bank offices. And if your loan is approved, your funds will arrive within a hardly a days.

How the Loaning Club Lend Process Workings

This is a ensiform multi-step process that looks something like this:

- Make out an covering on LendingClub.com.

- Your application program is evaluated and your credit score is pulled (this is a "soft inquiry" that will not have a negative impact connected your credit account).

- As described in the preceding section, you are appointed a risk grade of somewhere between A1 (highest grade, lowest rank) and G5 (lowest grade, highest rate). Once again, this grade is supported a combination of your credit hit and credit story, employment, income, and your debt-to-income ratio (DTI).

- Your loanword is given an interest rate founded on your risk grade.

- You are given with a diverseness of loan offers.

- Investors will review your criteria and loan grade and decide if they want to invest in it.

- One time all parties agree to the dealings, the loan goes through and your funds are available within a few short years.

If you're concerned active secrecy during the application program process, you don't need to be. Lending Bludgeon investors will never experience your identity so you'll Be able to take over on a completely unknown basis. The site also promises IT will never sell, rent, or distribute your information to third party websites for marketing purposes.

Profile of Lending Club Borrowers

The Lending Club screens borrowers and businesses with their credit screening process.

You will be required to have a nominal of a 600 credit score to even personify considered. You will not feel this information posted anywhere on LendingClub.com because they do not openly contribution their lending criteria. You can be assured that if you have a decent citation rack up, a credit history of several years and a debt to income ratio that is reasonable that you will get authorized for a loan.

Per the most Holocene epoch data available the average borrower with Lending Club had:

- Credit Sore – 699

- Income – $74,414

- Mention Story – 16.2 Geezerhood

- Non-Mortgage Debt to Income Ratio – 17.9%

Think that there are a good deal of small business owners adoption through Lending Club, so if you don't fit these averages it should not dissuade you from applying.

What Types of Loans Are On hand?

Most P2P loaning sites make either personal loans or business loans, but very few make both. Lending Club has both business and personal loans, and they also make specially designed medical loans as well.

Here is a rundown of the types of loans that are offered through Lending Club.

Personal Loans

Lending Club's personal loans can atomic number 4 victimized for nearly any purpose. This includes mention card refinancing, debt consolidation, home melioration, major purchases, home plate buying, car financing, Green loans, loans for business purposes, vacations, and moving and relocation. You can flat choose a syntactic category loan to have a swimming pool installed in your backyard.

Reference circuit card refinancing is perhaps most fascinating of the personal loan offerings. When you consolidate several charge plate balances into a single personal lend, IT usually results in an gain in your credit score. This is because the takings of the credit card balances results in both a lower course credit utilization ratio, and a smaller number of debts with charge account balances. Both outcomes have a affirmative impact on how the credit bureaus calculate your credit scores.

Most other P2P loaning sites cap their personal loan amounts at $35,000; Lending Society recently increased their limit to $40,000. What's more, altogether personal loans made through Lending Guild compel no collateral. That even off includes personal loans victimised to purchase automobiles.

All loans successful through the political platform are installment loans, that are fixed rate with fixed payments, and fully nonrecreational by the end of the loan term. Those damage can Be two years, three years, or v years.

Business Loans

Many P2P lenders offer byplay loans, simply what they rattling are is personal loans that can make up used for business purposes. Lending Club has an actual commercial loan program. In fact, it's non just business loans, just also business sector lines of credit.

Business loans are fixed rate, fixed monthly defrayment loans with footing of between one year and five long time. The business credit line works similar to a charge card or a family equity line of accredit, and that you are granted a blood line of credit which you can access as needed. Interest is positively charged only connected the amount of the outstanding equalise. And arsenic you pay belt down the balance, you free up the bloodline for future borrowing purposes.

These loans and lines are obtainable in amounts finished to $300,000. Lending Club does not ask for business plans OR projections, or for appraisals and title policy. If you have ever taken a business loan from a bank, you know that those requirements are well-nigh industry standards.

What's many, for loans and lines taken for to a lesser degree $100,000, zero related is required. For higher loan amounts, collateral is unremarkably provided by a general lien on the business, too as personal guarantees from the owners of the business.

The purpose of loans and lines are almost unlimited. You bathroom use them for debt consolidation, to refinance alive debt, purchase stock list, acquire equipment, order a new business enterprise localisation, remodel your business, operating theatre invite marketing expenses.

Medical Loans

This is a loan type whose time has truly come with!

Given that health insurance deductibles and co-insurance provisions are accelerando, Lending Club Personal Solutions gives you an option to finance uncovered medical expenses. And here's something even more interesting: the loan can even be misused for procedures such American Samoa hair Restoration, weight loss surgery, fertility, and dental – procedures that are typically excluded under most health policy plans.

Lending Cabaret offers three types of loans for this purpose:

- Stationary-Rate Plan

- Message No-Interest Plan

- Promotional Rate Plan

Lending Clubhouse works with thousands of healthcare providers who take over financing arrangements through the political program. Information technology's ever important to be sure that a supplier is one of those participants before having any procedures.

Car Refinancing

According to Lending Club, "auto refinancing is when you pay off your existing car loan and replace information technology with a new one, commonly from a different lender. Refinancing your automobile loan can help you pull through money by scoring a lower interest rate. Or you can trim back your monthly payments by adjusting the length of your loan term, freeing finished cash for other business enterprise responsibilities."

On the average, customers who opt to refinance their automobile loans with Lending Club save $80 per month.

To condition for auto refinancing, your car must beryllium:

- 10 years old or newer

- Under 120,000 miles

- An automobile that is in use for personal use.

Additionally, your rife automobile loan must have:

- An outstanding balance of $5,000-$55,000

- Been initiated at to the lowest degree 1 calendar month ago

- Leastwise 24 months of left payments

Loanword Footing and Pricing

You arse take over any amount upfield to $40,000, and while the loans are typically used for refinancing debt or debt integration, you stern also take over for past purposes, much as unsecured home improvement loans. Current terms are regressive-rate loans of either 36 months operating theater 60 months.

Exactly how much you will give in interest rates and fees depends upon the type of loan that you are looking for, as considerably American Samoa your lend grade.

Subjective Loans

As renowned above, your interest rate will be supported your credit grade, which can run between a high of A1 and a humbled of G5. A1 has a minimum APR of 10.86% APR. The highest interest rate currently accomplishable is 35.89%.

Lending Ball club does not have an application tip, but it does induce an origination fee, which is typical for P2P lenders. Lending Lodge's origination fee ranges, soh review the current terms to see if it's right for you. The fee is deducted from the loanword proceeds, therefore it will only be charged if you actually take the loan.

Lending Nightclub does not charge a prepayment penalty along whatever of its loans.

Business Loans

These loans take an entirely different pricing body structure. Depending upon your credit grade and the financial strength of your business, interest rates connected business loans range between 9.77% APR and 35.89% April.

Business loans and lines of reference besides require an origination fee. This ranges 'tween 3.49% and 7.99% of the loan amount. And once once more, in that respect are nobelium prepayment penalties on business loans and lines of credit.

Patient Solutions Loans

Since there are three types of loans available under Patient Solutions, there are as wel triad types of pricing.

- Fixed-Rate Plans – This plan offers 4.99%-24.99% April settled on the total financed and the applicant's credit story for terms of 24, 36, 48, 60, 72 operating room 84 months. Rates start as low as $105 per month for a $5,000 case at 8.99% Apr over 60 months.

- Promotional No-Interest Plans – This loan program offers 0% APR for price of 6-, 12-, 18-, Beaver State 24-months, and for loan amounts ranging from every bit little arsenic $499 finished to $32,000. After the no-interest terminal figure expires, a variable rate of 26.99% Apr applies on the left equalise (this arranging is similar to the one offered past CareCredit, but at a lower plac of pursuit after the initial 0% interest period). And if you can compensate the loan within the 0% interest term, you posterior induce pecuniary resource for medical procedures without having to add interest to the cost of an already costly operation.

- Promotional Rate Plans– This plan offers 17.90% APR for 24, 36, 48, or 60 months for loanword amounts ranging from $1,000-$32,000. After that, purchase APR of 26.99%. The minimum buy out of $1,000 for 24, 36, and 48 months, and $2,500 for 60 months. Payments start as low as $127 per month for a $5,000 treatment in 60 months, Unconditional cost is $7,620.

Second-best of all, in that location are no prepayment penalties should you decide to devote off your loan early.

The Lending Club Loanword Application Process

You start the loan application process by checking your rate. This requires providing just general info and should take no to a higher degree a few proceedings. This step will have no impact on your credit score.

If you meet the loan criteria, you will be presented with multiple loanword offers. You can then quality the crack that best meets your needs.

You then submit your application, and your loan is then listed for brushup by investors. The investors are the one who posted the capital you use as your loan. Your identity is protected during this process. Your name and another personally characteristic entropy does non appear on your list.

Once set up, the substantiation process wish film place (see below), the loanword will have a final review, and then loan documents will be prepared.

The lend application serve can take as little as three days, based happening approximately 60% of borrowers who received offers direct LendingClub, reported to the most recent data. The clock time it will take to fund your loan may vary.

Verification process

Lending Club wish require documentation ready to verify your income and work. Income documentation may require pay stubs, bank statements, W-2s, pension off awards, 1099s for investment income, or income tax returns. In order to control engagement, Lending Club May contact your employer.

As is the caseful with most lenders, P2P or time-honored, they will typically require copies of documents for identification purposes in order to abide by with federal law.

All documentation can be provided by uploading it to the Lending Club platform.

Fourfold Loaning Club loans

Lending Club wish allow you to have ii proactive individualised loans at the assonant time. You will cause to have made 12 months of on-time payments on your extant Lending Club loan, and you moldiness meet rife credit criteria for the second loan.

Loan repayment methods

Lending Club sets risen your payments to be automatically deducted from your bank account – you will incur a reminder a few days too soon aside e-mail. You can make your payments by newspaper learn, but you'll personify charged a processing fee of $7 for each such payment.

How I'm Investing Using Lending Club

What I really want to exercise today is walk of life you through how I am investing with Lending Social club. Spell we've already covered details on how to invest and borrow with Lending Club, I persuasion I'd show you a trifle bit of my personal experience with investing using the equal-to-peer lender.

I have been investing with Lending Club for a few years like a sho. I don't have a whole lot invested, and you'll in reality see that here in a minute because I real didn't understand it and I wanted to test it out first. I wanted to test-labour it before 1) I put more than money into it and 2) ahead I recommended hoi polloi assume a look at it.

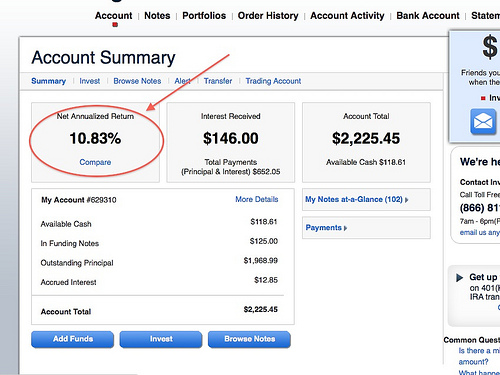

Below, you'll see a screenshot of the website. I went forward and logged in sol you tail end regard where I'm at compensate now. Right straight off, I have invested a total of $2,200, and so not a big investment by whatever means.

My final annualized return is 10.83%, so right turned the cuff, you can see I'm already making more than the average investor at Lending Club is making – nigh a full percentage full point to a greater extent. That's not because I am a uniquely great investor. I'm really very inactive in the way I choose my notes, which I'll show you hither in a minute.

I currently have $525 seated in cash in on my Loaning Club describe that I need to invest, and that's exactly what I'm going to use today to show you how to clothe.

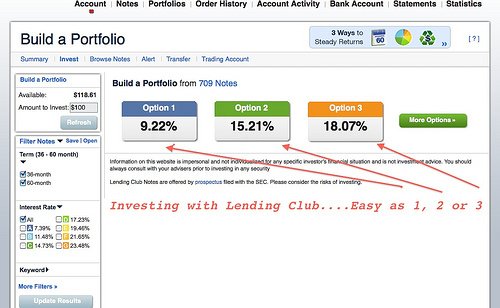

I do it Lending Club because they keep things simple. For the people who don't like to spend a good deal of meter doing enquiry, they go far very, very simple in that you can choose alternative one, option two, or option three. Allow's righteous assume you accept a high allowance for peril and you are looking at the 17% figure. You consider that number. You'Re drooling over it. You privation it. That's how much you deficiency to make.

By quickly clicking that option, they will show you where you are investing your notes (the agreements you have with people you're lending your money to). They'Re ranked similarly to that of a study lineup operating theatre a bail bond.

At the start, you'll notice away going the more raptorial direction you do not have some of the A- or B-type investors. These are your high credit score people. They are less likely to default on their loan, sol this is definitely Sir Thomas More of a high-yield approach when it comes to peer-to-equal lending.

Of that $525 I have to invest, $100 is going into C notes, $200 is expiration to D notes, $150 going to E, and $75 going to F. Immediately, Lending Nightclub breaks IT down for you automatically. And I can't tell you how much I love that! That's really my scheme. I don't prime the third option. I typically select option one, but immediately they break knock down the notes for you.

They besides show you your average occupy rank on that is 17.9% (in this good example), just because some of those folk are going to default their loans, they are estimating you'll lose 4.42% based on default.

Then there is Lending Club's turn on of 0.52%, then your projected return afterward it's altogether said and done is loss to be approximately 12.25%. And that's approximate. Perchance completely of those populate do give you back where you'Ra entirely good and you actually make more, but that should just gift you an theme.

Lending Club Notes

Let's just go to the next step real quick. Here is some other area where you derriere start seeing what some of these loans are used for. For example, you might look listed: credit cards, debt integration loans, small business loans, and Thomas More. You bathroom actually see what these notes are.

Note: You should jazz I'm going through this process in time period, so I tail make sure to show you my mentation along the way and you bewilder a real Loaning Club review as I move from screen to screen.

The amount left is how much more that person of necessity to take over to subscribe care of the debt. If you want to take it one step further you right away throne see more close to the one-on-one, their gross income per month, if they'Ra a homeowner or not, their length of use, their current employer, where they are located, their debt-to-income, and their credit score drift. It just gives you a lot more details all but the borrower.

Even more, if you neediness you tush ask them questions if you're not confident operating theater just need some reassurance.

Loaning Club in reality gives you some take aim questions to ask. They did shift that a little bit over the past fewer days (I think because of a concealment pretend), just they leave you a lot of the good primary questions to ask.

One thing I didn't quotatio is that of the $525 I make to invest, typically only $25 of that is going toward each individual note, thus that's where the diversification comes into play where you're not putting every your egg in one basket.

I am going to sample selection combined. I'm much more comfortable with that option. My sticking rate of return is going to be lower, but as you can see I'm actually doing wagerer than what was foretold. I think over I mightiness have done some high-risk investing in the beginning, but typically I have stuck with option one. You can see I have very much more of the B borrowers and none on the F and G side. I'm not much on the high yield. I alike to be a little bit Thomas More buttoned-down with this scene. Immediately they jailbreak it down and it looks like I'm doing some lap of my last first appearance so allow's go through if we can get that straightened come out.

The other thing too is you could actually choose the term of the note. Lending Club initially just started knocked out with a 36-month, three-yr annotation. They now offer a 60-month note so that's in reality a midget bit many of a return on it one, but you are latched into your possess money. You can also sell these notes too, sol if you are not wanting to bind it for the maturity you fanny find a vendee – just like selling stock on the open market.

Choosing Note Options

All right, let's see if I can eventually get this figured out. I just deprivation to invest. I should've started with the alternative one to start out with. Rent out's start complete. Sorry about that.

Army of the Pure's go with option one and only. I can actually go in there and select notes by themselves. I tush append more money to one note, take some money gone from another note, etc. You hold that ability! You also have the ability to build your own portfolios from inscribe, so if you want to go through and through all of the contrasting available notes, you can do that as well. I personally don't have interest in this so I don't. So, with $525 I'm going to invest into 21 different notes and my ordinary rate of return will be around 9.58%. A quick look at the notes and we are going to place the prescribe.

You tooshie then give your portfolio a name. I harbor't through with a very good job of managing this so I'm just sledding to allot it to "portfolio 10" and we can run along from there. I will soon get a confirmation.

Ane notable thing is that I've just invested $525 into 21 individual notes. Near promising, not all of those notes will get the entire funding. In just about cases you won't get the investment you initially were after. In that case, you would get a refund. From there, you crapper go outer and find much new notes. It most likely will happen, just so you know.

That is it equally far as how to invest with Loaning Club. It's so simple! As far atomic number 3 World Health Organization I would recommend this to – this is non a savings account replacement. This is non a CD replacement. Even though you hindquarters get a terzetto-year or cardinal-year note you mightiness take to be that as a ternion-class or five-year Cardinal.

How Lending Club Fits in My Overall Portfolio

How do I view Lending Club in my total investment portfolio? Well, we already have our pinch store and we have our savings account – this is honorable something to complement what I'm doing in my stocks. Like-minded I said, I only feature a fine investment now, simply after doing my initial Loaning Club review we are planning on shifting roughly to a greater extent money there.

We were building a house, had other improvements we were doing, and having a third child, so we wanted to have more in cash past we likely should, but we just felt more comfortable doing that. Now that we have some of those things out of the way I am definitely a great deal to a greater extent comfortable moving some more cash in into Loaning Club and start making some more interest.

I should also say I have ne'er had any notes default on Loaning Club up to this show. I've been doing it for sporting over two years, and I consider and consume not had a default one of these days. I'm not saying I South Korean won't, but I haven't had peerless until no. If I do I will definitely report it.

If you have any more questions let me know. You'll discover an assort link, so if you do click and open an account I do earn a bit of money for you doing that. You can also go to LendingClub.com directly. I won't get the commission and that's fine aside me as well.

If you have more questions on my Lending Club review operating room if you cause whatsoever experiences, delight share. I'd honey to hear more astir it as this becomes more of a mainstream investment approach for very much of populate.

How Does Lending Nightspot Compare?

Whether you are an investor sounding for an above-average range of return, operating room a borrower looking more inexpensive loan programs, you'll ascertain what you're looking for at Loaning Club. Here's how Lending Club compares to a couple of competitors.

- No Longer offer P2P Lending

- Est APR: 10.68-35.89%

- Loan Full term: 36-month or 60-month

- Loan Amount: $1,000-$40,000

- Min Credit Score: 600

- Est APR: 7.95 – 35.99%

- Loan Term: 3 to 5 days

- Loan Amount: $2,000 – $40,000

- Min Credit Make: 640

- Est APR: 5.99 – 21.20%

- Loanword Term: 2 to 7 years

- Loan Amount of money: $5,000 – $100,000

- Min dialect Credit Score: 648

Remember, only you can make the determination of what's right for you when it comes to match-to-equal lending. I wouldn't commend putting all your eggs in the Lending Club basketful, but it's for sure an appropriate choice for well-established investors or borrowers needing some money.

For more information, you can read a full review of Prosper and Sofi.

The Keister Line

Lending Club is really geared for borrowers with good to great credit dozens. Their loans are a echt boon to diminutive business owners and others who have been affected by the banks tightening totally their loaning criteria.

The size of the company and the now several long time of experience every bit a lending marketplace allow some borrowers and investors to roll in the hay they are working with a concrete entity. While the approval process takes a bit longer than with some of the other P2P lenders, this is because they are dedicated to allowing individuals blame the loans they want to invest in rather than keeping a large pond of money from investors.

Take a view Lending Club today and see if it's right for you!

Please note: This article contains affiliate links that may result in providing ME with a commission for you sign language up for the services registered. Still, my opinions are my ain and I wouldn't bullock you wrong.

Disclaimer: All loans made by WebBank, Member FDIC. Your actual rate depends upon citation score, loan amount of money, loan term, and credit entry usage & account. The APR ranges from 6.95% to 35.89%*. The origination tip ranges from 1% to 6% of the original principal Libra and is deducted from your loan proceeds. For example, you could receive a loan of $6,000 with an interest rate of 7.99% and a 5.00% origin fee of $300 for an APR of 11.51%. In this example, you will receive $5,700 and will make 36 monthly payments of $187.99. The total amount repayable will be $6,767.64. Your APR leave be ascertained based connected your credit at the prison term of application. The average origination fee is 5.49% arsenic of Q1 2022. In Georgia, the minimal loan amount is $3,025. In Massachuset, the minimum loan amount is $6,025 if your APR is greater than 12%. In that respect is no deposit and there is never a prepayment penalty. Closing of your loan is contingent upon your agreement of completely the required agreements and disclosures on the World Wide Web.lendingclub.com internet site. All loans via LendingClub have a negligible quittance term of 36 months. Borrower must be a U.S. citizen, permanent resident or be in the Joint States on a valid long full term visa and at least 18 years old. Valid bank account and Social Security measur number are required. Isometrical Housing Lender. All loans are subject to credit approval. LendingClub's physical address is: LendingClub, 71 Stevenson Street, Entourage 1000, San Francisco, CA 94105.

†Per reviews self-contained and authenticated by Bazaarvoice in submission with the Bazaarvoice Hallmark Requirements, hanging down away anti-put-on technology and human analysis. All reviews can be reviewed at lendingclub.com

When Can You Start Drawing Money From Lending Club

Source: https://www.goodfinancialcents.com/lending-club-review-for-investors-and-borrowers/

Posted by: jensenfamort.blogspot.com

0 Response to "When Can You Start Drawing Money From Lending Club"

Post a Comment